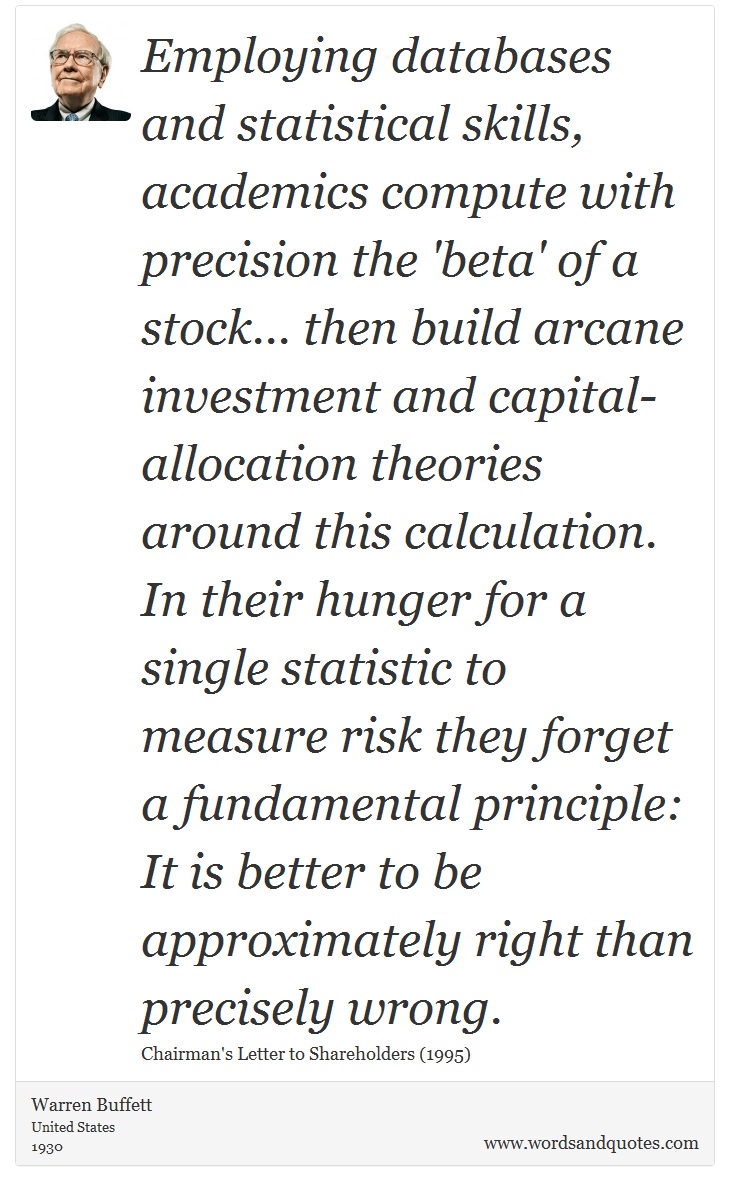

Warren Buffett

Employing databases and statistical skills, academics compute with precision the 'beta' of a stock... then build arcane investment and capital-allocation theories around this calculation. In their hunger for a single statistic to measure risk they forget a fundamental principle: It is better to be approximately right than precisely wrong.

Chairman's Letter to Shareholders (1995)

Quote Image

Search

On Anger: "For every minute you remain angry, you give up sixty seconds of peace of mind."

Essays

Essays

On Destiny: "Our destiny exercises its influence over us even when, as yet, we have not learned its nature: it is our future that lays down the law of our today."

Human, All Too Human

Human, All Too Human

On Friendship: "A crowd is not company; and faces are but a gallery of pictures; and talk but a tinkling cymbal, where there is no love."

Essays

Essays